Small Business Health Insurance

Get Group health insurance quotes in less than 2 minutes! View the lowest rates available on coverage for California.

Small Business and Group Health Insurance California

We’ve realized that most employers have a rough time understanding how Obamacare has changed group health insurance in California. They want to know why the benefits and rates have changed so drastically. We’ve got a quick overview of everything you need to know below.

4 Things You Need to Know About Obamacare and Group Health California

Here’s what to know and understand:

1. Obamacare Has Changed the Way Insurance Providers Calculate Rates for Group Medical Insurance

Before 2014, all small group medical insurance plan rates were based on the age of an employee. For instance, if an employee fell within the age range of 20-29, 30-39, etc., then there was a single rate for that age range.

Additionally, it didn’t matter how many children the employee had or if their spouse was young or old. There was one rate for the whole family, and everything was based on the age of the employee. This is no longer the case. Now, the rate for small group medical insurance is based on the exact age of the employee as well as the age of the spouse and children.

Keep in mind that the ACA also eliminated the consideration of pre-existing medical conditions as a basis for determining health rates. In California, this means that the “Risk Adjustment Factor,” which allowed rates to vary by your pre-existing medical conditions, was eliminated. Now, it doesn’t matter if your employees are in good health or not. You get the same rates.

2. Obamacare Uses Standard Benefits and Metallic Tiers to Compare Health Plan Benefits

Medical insurance is not only complicated, but it’s also expensive. To help people understand the plans and compare one plan with another, Covered California uses a standardized model to determine the rates an insurance plan pays for physician visits, hospitalizations and other benefits.

The result is an AV (Actuarial Value) which sorts the plan into four different categories: Bronze, Silver, Gold and Platinum. A Platinum plan is the most beneficial plan, which means the insurance plan pays most of the costs while the patient pays the least. In a Platinum plan, the insurance provider pays 90% while you pay 10%. In a Bronze Plan, the insurance pays 60% while you pay 40%. The ACA does not allow plans that cover less than 60% of the health costs.

3. Insurance Providers Use Physicians and Hospital Networks to Reduce Costs of Plans

Health care costs vary dramatically between physicians and hospitals. Some are inexpensive, and others are expensive. Health insurance plans that include low-cost providers charge less than those that include high-cost ones.

By enrolling in a health plan that excludes expensive doctors and hospitals, employees can get comprehensive benefits at a modest cost.

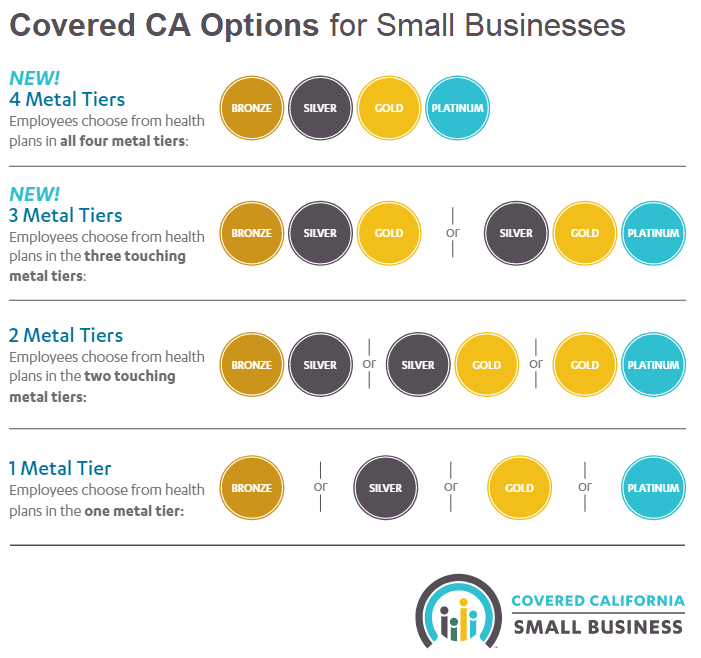

4. Small Employers Can Offer a Range of Health Insurance Plans to Meet Employees’ Needs

Employees have different needs when it comes to health insurance. Some employees never visit the doctor and only need catastrophic coverage. Others have serious illnesses like diabetes and need a health plan that can cover most of their needs with little contribution from them. The good news is that an employer can tailor insurance plan benefits to meet the needs of the company as well as those of the employees.

Some employers can offer a single plan to every employee. Others can offer single HMO or PPO plans. Still, others can offer four to six different plans and allow the employees to choose the one that fits their needs. We understand that offering five to six plans can get quite overwhelming for employees, but insurance providers allow small employers to offer 15 or more plans while minimizing the cost to the employer.

Small Business Enrollment Applications for Employers and Employees

Use the links below to enroll in small business health insurance through Covered California including dental:

- Covered CA Small Business – Employer Application – Enroll your business.

- Employee Application – Enroll specific employees on the health plan.

Covered California for Small Business

You’re eligible for Covered California for your small business if:

- You have at least one W-2 employee, in addition to owners, officers or spouse thereof.

- Federal Employer Identification Number (FEIN).

- Payroll Records

Get Group Health Insurance Quotes in California

Running a small business is difficult enough without all the confusion that group health insurance can bring. Use our online services at HFC to get free, instant quotes for group health insurance for your business. Just fill out a simple form. It takes less than a minute to complete, and you are under no obligation to buy or provide contact information.