Covered California Income Limits

Many Californians looking for health insurance coverage turn to Covered California. This free service connects you to the state’s Medi-Cal program or shows you plans from well-known health care providers. Covered California also offers subsidies based on your household size and income, with various health plans to consider. This marketplace makes health insurance more accessible for Californians, especially those without coverage from government programs or employers.

California residents who are also United States citizens or lawfully present immigrants may be able to find health insurance via this platform. Eligibility depends on the income bracket. These income limits help ensure the right people receive the right amount of help to afford health insurance.

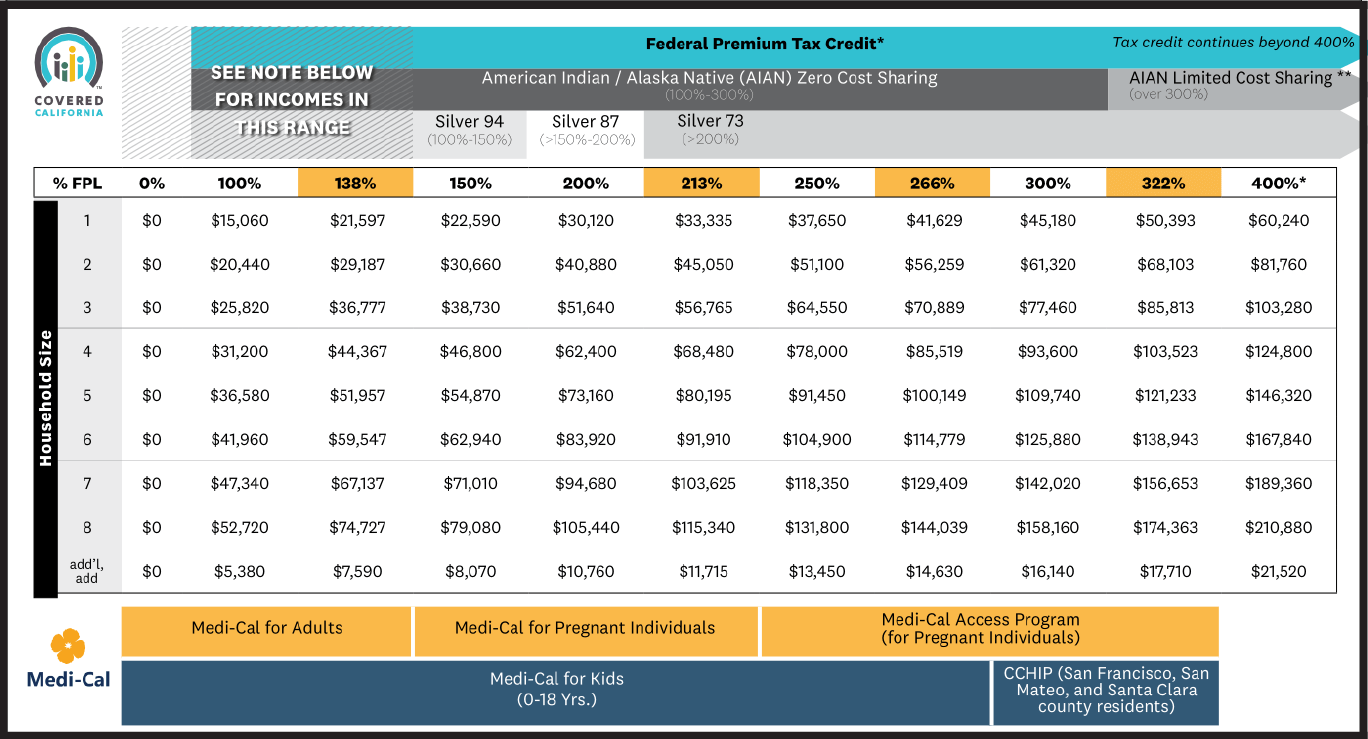

View the 2025 Income Chart below, or click 2024 Income Chart to see the previous version.

Program Eligibility by Federal Poverty Level for 2025

Your financial help and whether you qualify for various Covered California or Medi-Cal programs depends on your income, based on the Federal Poverty Level (FPL).

* Consumers at 400% FPL or higher may receive a federal premium tax credit to lower their premium to a maximum of 8.5 percent of their income based on the second-lowest-cost Silver plan in their area.

Understanding the Covered California Income Limits

Covered California sets limits on who can get financial assistance and the kind of coverage they qualify for. These income limits require consumers to have a household income between 0% and 400% of the Federal Poverty Level (FPL) to qualify for government health insurance plan assistance. Based on your household income, you may also qual

Here are the criteria to be eligible for coverage:

- You must be a California resident.

- You cannot be enrolled in Medicare or have employer-sponsored health care.

- You must be a lawfully present immigrant.

Note that free health insurance plans are available, as California’s low-income cutoffs are below $47,520 a year. Families of four who earn wages below the median household income in California — $97,200 per year — qualify for government assistance based on their income. If the family has a lower household net income, more government assistance is available to the family. Tax deductions can lower your income level.

Where does Medi-Cal fit in? Medi-Cal, California’s Medicaid program, provides health coverage to eligible low-income households. In relation to Covered California, this is the state’s health insurance marketplace.

Types of Covered California Income Limits

Income limits are subject to three variables. First are the income sources, followed by household composition effects, like families with mixed immigration statuses. Finally, seasonal income is considered, as these potential fluctuations can impact applications. These variables determine an individual’s or family’s eligibility for Covered California and Medi-Cal.

Modified Adjusted Gross Income (MAGI)

MAGI is your adjusted gross income from your tax return with additional items factored in, including:

- Tax-exempt interest.

- Non-taxable Social Security benefits.

- Foreign earned income and housing expenses.

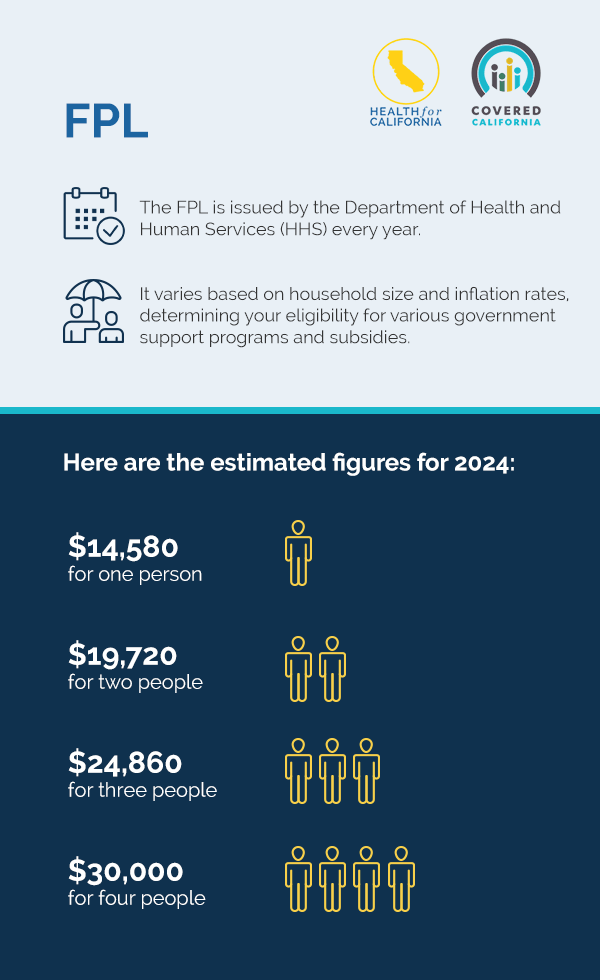

FPL

The FPL is issued by the Department of Health and Human Services (HHS) every year. It varies based on household size and inflation rates, determining your eligibility for various government support programs and subsidies. Here are the estimated figures for 2024:

- $14,580 for one person

- $19,720 for two people

- $24,860 for three people

- $30,000 for four people

Medi-Cal Income Limits

Medi-Cal income limits are based on a percentage of the FPL and vary by group:

| Adults between 19 and 64 years old | Children aged 18 or younger | Pregnant women | Aged, blind or disabled people | |

| Eligibility | At or below 138% of the FPL | At or below 266% of the FPL | At or below 213% of the FPL | Generally up to 138% of the FPL, based on different income and asset limits |

Plans Based on Income

Plans are divided into Bronze, Silver, Gold and Platinum levels. Bronze plans have high out-of-pocket costs with low premiums, whereas Platinum plans have high premiums but low out-of-pocket costs. Choosing the right plan involves balancing your premiums with what you are willing to pay when you need care.

All plans cover your essential health benefits, most preventive services and a customized network of doctors and hospitals with coverage. Staying within this network helps keep your costs lower. Open enrollment typically runs from November 1 to January 31, during which you can sign up for a plan. Outside of this period, you need a qualifying life event — like getting married, having a baby or losing a job — to enroll.

| Bronze Plan | Silver Plan | Gold Plan | Platinum Plan | |

| Premiums | Lowest | Moderate | Higher | Highest |

| Out-of-pocket costs | Highest | Moderate | Lower | Lowest |

| Coverage | Covers about half of your health care costs |

Covers more than half of your health care costs, with cost-sharing reductions |

Covers most of your health care costs |

Covers almost all of your health care costs |

| Ideal for | Anyone prioritizing low monthly premiums |

Anyone who qualifies for cost-sharing reductions |

Anyone willing to pay higher monthly premiums |

Anyone who needs a lot of medical care and can pay higher premiums |

Silver-Enhanced Plans

Based on your average salary in California, you may qualify for Cost Sharing Reduction (CSR) on the Silver Plans:

- 0% – 138% of FPL: You qualify for Medi-Cal.*

- > 138% – 400% of FPL: You qualify for a subsidy on a Covered California plan.

- > 138% to 150%: You also qualify for the Silver Enhanced 94 Plan.

- > 150% to 200%: You also qualify for the Silver Enhanced 87 Plan.

- > 200% to 250%: You qualify for the Silver Enhanced 73 Plan.

*Note: Children qualify for Medi-Cal up to 266% of the FPL. So, children would not qualify for CSR or Enhanced Silver Plans 73, 87 or 94.

According to Covered California income guidelines and salary restrictions, if an individual or family makes less than 400% of the FPL, they qualify for government assistance based on their income.

Health Insurance Income Limits During Pregnancy

Pregnant women in California have access to increased income limits for health care coverage through Medi-Cal to ensure they receive comprehensive care during pregnancy. If their income exceeds Medi-Cal limits, Covered California’s financial assistance still makes their health care more affordable.

Under the Affordable Care Act, all marketplace and Medicaid plans must provide pregnancy and childbirth coverage. You qualify for pregnancy coverage even if you’re already pregnant when you apply for coverage. Health coverage is important when you’re planning on having a baby because:

- It makes it easier to get prenatal care: Pregnant women should see their doctors regularly throughout the pregnancy to track the progress and detect any issues. Detecting problems early on helps ensure the health and safety of you and your baby.

- It makes the delivery affordable: The U.S. is known for high delivery and maternity care costs. You might have to pay something out of pocket. However, depending on your income and health care coverage, insurance cuts the cost of delivery considerably.

- It gives you access to emergency care: Everyone wants a healthy pregnancy, but complications can occur. Getting immediate access to emergency treatment and care can help save you and the baby.

Since access to health coverage and health care is critical during pregnancy, the income requirements for pregnant women are slightly different than those for people who aren’t currently expecting a baby. Here’s what you might qualify for, depending on your income level:

- Medi-Cal: If your earnings fall between 138% and 213% of the poverty level, you may qualify for MAGI Medi-Cal during your pregnancy.

- Medi-Cal Access Program (MCAP): The Covered California income limits for MCAP are between 213% and 322% of the poverty level. MCAP charges a small fee and provides comprehensive coverage for pregnant individuals.

When you apply for Medi-Cal while pregnant, your eligibility is presumed while your application is reviewed. That means you can take advantage of immediate coverage, ensuring you and your baby get the care you need.

Income Limits for Medi-Cal for Families With Children

Adults qualify for Medi-Cal with an average household income of less than 138% of the FPL. However, according to the Covered California income guide, children who enroll in Obama Care California plans may qualify for Medi-Cal when the family has a household income of 266% or less. The children must be under 19 years of age to qualify. Also, C-CHIP, the County Children’s Health Initiative Program, offers health care coverage for children when the family income is greater than 266% and up to 322% of the FPL.

How to Provide Proof of Income

Proof of income for your Covered California application can differ slightly, depending on whether you are self-employed or have an employer. For the latter, you will need to provide the following:

- Your most recent pay stubs, showing year-to-date earnings

- The previous year’s W-2 forms (if you have no W-2 forms or pay stubs, a letter from your employer confirming your income)

Self-employed individuals need to gather these documents:

- 1099 Forms from businesses or clients who paid you

- Your most recent deferral in your California income tax return, including attachments and schedules

- A statement detailing your current year’s income and expenses

- Bank statements showing deposits related to your self-employed income

If you have additional income sources, add these documents to your application:

- A benefits letter from the Social Security Administration

- Documents showing your pension or retirement income

- Documents confirming any unemployment benefits you received

- Legal documents or statements showing alimony you received

- Statements from your investment accounts showing dividends or interests received

Streamline your application process by submitting your documents without delay, ensuring they are clear and legible. Complete all the necessary fields on multi-page documents.

Reporting Mid-Year Changes in Household Earnings

If your average income in California increases during the year, this may affect what levels of subsidies you qualify for according to Covered California income limits. It also may affect whether you, your spouse or your children qualify for certain government assistance programs. If you have a significant income change mid-year, you may be required to report that to Covered California or Medi-Cal.

Reporting these changes ensures you get the right amount of financial assistance, helping you avoid potential penalties. Changes to report include wages or salary increases and decreases, self-employment income adjustments, changes to unemployment benefits and one-time payments like a bonus or inheritance. Household changes include a marriage or divorce, birth or adoption, death of a household member or a dependent losing eligibility for coverage due to their age.

You should also report any changes in your taxes in California on income, address or the gain or loss of other health coverage. Reporting these changes can ensure your continuous coverage, a special enrollment period that allows you to change your health plan or a subsidy adjustment.

Get a Quote and Calculate Your Covered California Discount

Understanding the income limits for Covered California is essential. This information will help you determine your eligibility and assess the financial assistance you could receive for health insurance. When you know what you want to apply for, streamline the application process by gathering the necessary documents and completing them in a timely fashion.

If you need health insurance or help affording health coverage, you might qualify for Medi-Cal or a subsidy. Health for California can help you determine whether you qualify for a subsidized or Medi-Cal plan based on your income and current situation. Get a quote today.