Covered California Small Business Health Options Program (SHOP)

Posted: July 30, 2014

by Holly Davies

As a small business owner in the golden state of California, you may be wondering if you can offer affordable small group health insurance to your employees. The SHOP helps you offer a variety of plans while keeping group administration simple and keeping the cost as low as possible.

The SHOP Marketplace is a part of the official California Health Benefits Exchange and is the only place where you can access tax credits under the Affordable Care Act (ACA). The maximum tax credits can be as high as 50% for a small business and 35% for nonprofits. If you have fewer 10 or fewer employees earning less than $25,000 per year we can calculate your estimated tax credit. You will be required to cover 50% of the health premium for employees and the tax credit will lower the amount that comes out of your budget. Your group is one of kind, so we will help you discovered what you are eligible for.

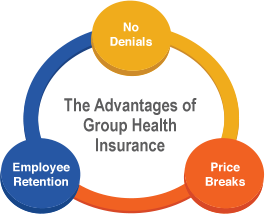

The advantage of offering employer-sponsored health plans depends on your own business philosophy. Some owners may use the health benefit offer as a bargaining tool when recruiting and retaining valued workers. Employees with health coverage are more likely to receive appropriate medical care which can prevent excessive sick days and lowered productivity while at work. Tax credits through Covered CA are a new incentive to cover your employees. Best of all, your employees will have a greater sense of security and significance.

The advantage of offering employer-sponsored health plans depends on your own business philosophy. Some owners may use the health benefit offer as a bargaining tool when recruiting and retaining valued workers. Employees with health coverage are more likely to receive appropriate medical care which can prevent excessive sick days and lowered productivity while at work. Tax credits through Covered CA are a new incentive to cover your employees. Best of all, your employees will have a greater sense of security and significance.

New and unique coverage options are available when we enroll your group through the SHOP. You get to choose the level of coverage you want to offer to the group. They employees may each choose which of six insurance carriers they want to use. While one employee may want to choose Blue Shield so they can keep their current doctors, another will choose Kaiser Permanente because of certain electronic conveniences. Employees decide if they want to enroll dependents on the group at their own expense or purchase other coverage offered through Health for California Insurance Center. To make it easy on you, it all comes on just one monthly billing statement.

- A small business is eligible for group health coverage when:

- Your primary business address or primary workplace is in California

- You have 1 to 50 eligible employees, and

- Offer coverage through SHOP to all full-time employees, that average 30+ hours per week

- Have a current Local Business License or Fictitious Name Statement

- Have a copy of your reconciled DE-9C Payroll Report (EDD)

- Additional business documents may apply

This may sound complicated at first, but we are very familiar with these and will guide you through. Most businesses already possess the correct documents. If your business is not eligible yet we will support you by letting you know what you can do to become eligible and offering alternatives.

Our team is eager to help you find answers to your questions. For a rate quote, plan details and applications we invite you to click here. To find out whether your company qualifies for a tax credit please call us at 1-877-752-4737, option 2 for personal assistance.