Types of Senior Health Insurance

Are you turning 65 or becoming eligible for Medicare soon? There are a number of ways that you can supplement Original Medicare.

Or call 1-800-352-4784

What are your Senior Health Insurance options?

Are you turning 65 or becoming eligible for Medicare soon? If so, you may be wondering about health insurance for seniors and the options available to you. There are a number of ways you can supplement Original Medicare.

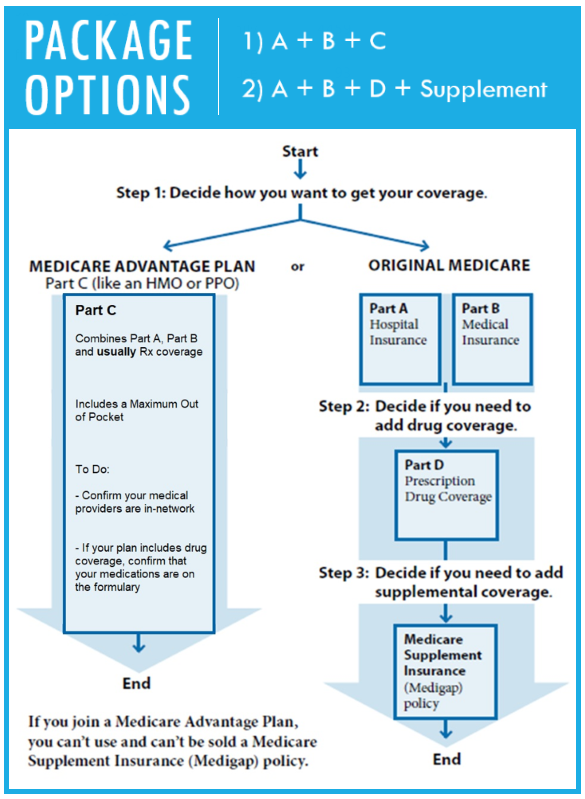

Medicare Advantage Plans

Medicare Advantage Plans, also known as “MA Plans” or “Part C,” are offered by private, Medicare-approved companies. These plans include:

- Preferred Provider Organizations (PPO)

- Special Needs Plans (SNP)

- Private Fee-for-Service Plans (PFFS)

- Medicare Medical Savings Account Plans (MSA)

- Health Maintenance Organizations (HMO)

By enrolling in a Medicare Advantage Plan, you ensure the Medicare services you receive are covered by your plan rather than by Original Medicare. Many of these plans offer coverage for prescription drugs. This type of plan is county-specific, so you have many different options depending on where you are located in California.

Prescription Drug Plans (Part D)

A Medicare Prescription Drug Plan Part D is a drug plan that provides coverage for prescription drugs to Original Medicare, assisting with prescription drugs, vaccines, biological products and some supplies not covered by Medicare Part A and Part B. Don’t take any prescriptions? You may still want to consider purchasing a Prescription Drug Plan for future prescription needs and to avoid a penalty from the government.

Eligibility and Requirements

Generally, you’re eligible for Medicare when:

- You’re 65 years old or older.

- You are not 65 but have a qualifying disability or End-Stage Renal disease.

- You or your spouse have worked for ten years for an employer covered by Medicare.

- You’re a citizen or permanent United States resident.

Enrollment

You can begin the enrollment process for Medicare three months before your 65th birthday. You should make sure your enrollment is complete three months after your birthday at the latest. This time is your Initial Enrollment Period. You can enroll by visiting the Social Security website or your local Social security office, or you can call them at 800-772-1213. When you enroll during this period, you can ensure you start getting your benefits as soon as you’re eligible for them and avoid paying penalty fees.

If you miss applying during your Initial Enrollment Period, your next option is to sign up during the General Enrollment Period that happens every year between January 1 and March 31. You may also be eligible for a Special Enrollment Period under certain circumstances.

If you already receive Railroad Retirement or Social Security benefits and you’re turning 65, you might be automatically enrolled in the program. If so, you’ll get your Medicare card in the mail either three months before your 65th birthday or once you’ve been on disability for 25 months.

Still Have Questions on Medicare Plans?

We thought you would! We trust our Medicare Insurance Partner and you should too!

We know there are many options and carriers when choosing your Senior Health Insurance plan. We also know how confusing it can be. That’s why we’re here to help make it quick and easy for you to find the right Senior Health Insurance plan for your needs.

We have been serving the California Medicare-eligible population for over 10 years now. We are a free-service brokerage that specializes in Senior Health Insurance. Our primary objective is to help you understand your Medicare options and answer all of your questions.

For live support, call 1-800-352-4784 or click here to schedule an appointment.